Diagnostic Kits/Give an overall picture of the Kits' sector

background:

(ADDED TO PAPER)

To quantify the Diagnostic Kit Market, we must start with a working definition. We use the phrase Diagnostic Kit to cover the In-Vitro Diagnostics (IVD) Market. The IVD market is composed of products which produce clinical data from a sample of tissue taken out of a patient (note that other diagnostic products such as medical imagers and in-vivo diagnostics are not included).

IVDs can be categorized based on the location of testing. The vast majority of routine tests are performed in-house hospital labs or in reference labs. These tests may be supplied as a complete kit to the testing laboratory or may be developed in-house with Analyte Specific Reagents (ASRs). ASR-based diagnostics are interesting because the ASRs are sold alone, without specific testing procedures, instructions, or supporting materials. Instead of purchasing a complete kit, labs (which must be CLIA high-complexity certified) purchase just the ASR and develop their own tests around it. Lastly, some kits are available directly to consumers over-the-counter. Of these, some can be operated in the home, such as pregnancy tests and blood glucose tests, while others require the user to ship a sample to a remote reference lab. DNA Direct is a company that operates in this space, providing gene-based OTC diagnostic kits that are evaluated in a remote lab.

- Priorities for Personalized Medicine, prepared by the Council of Advisors on Science and Technology (PCAST). Available at: http://www.ostp.gov/galleries/PCAST/pcast_report_v2.pdf

- "PCAST hopes that this report in its entirety helps lay a foundation for realizing important health care benefits from genomics-based molecular diagnostics, while providing a balanced assessment of the promise and current limitations of personalized medicine more broadly."

- Intellectual Property Section page 21

- "The ability to obtain strong intellectual property protection through patents has been, and will continue to be, essential for pharmaceutical and biotechnology companies to make the large, high-risk R&D investments required to develop novel medical products, including genomics-based molecular diagnostics."

- Issues raised specific to genomics-based molecular diagnostics

- changes in case law to make

- nonobviousness standard more stringent

- patent diagnostic correlations possibly not patentable

- expanding research and development exemption (really?)

- injunction relief for patent infringement made more difficult

- Patent Reform Act of 2007 (proposed but not passed)

- changes in case law to make

- "Therefore, PCAST strongly recommends that a separate PCAST subcommittee be convened to address these patent law issues across all domains and issue a report devoted exclusively to these issues."

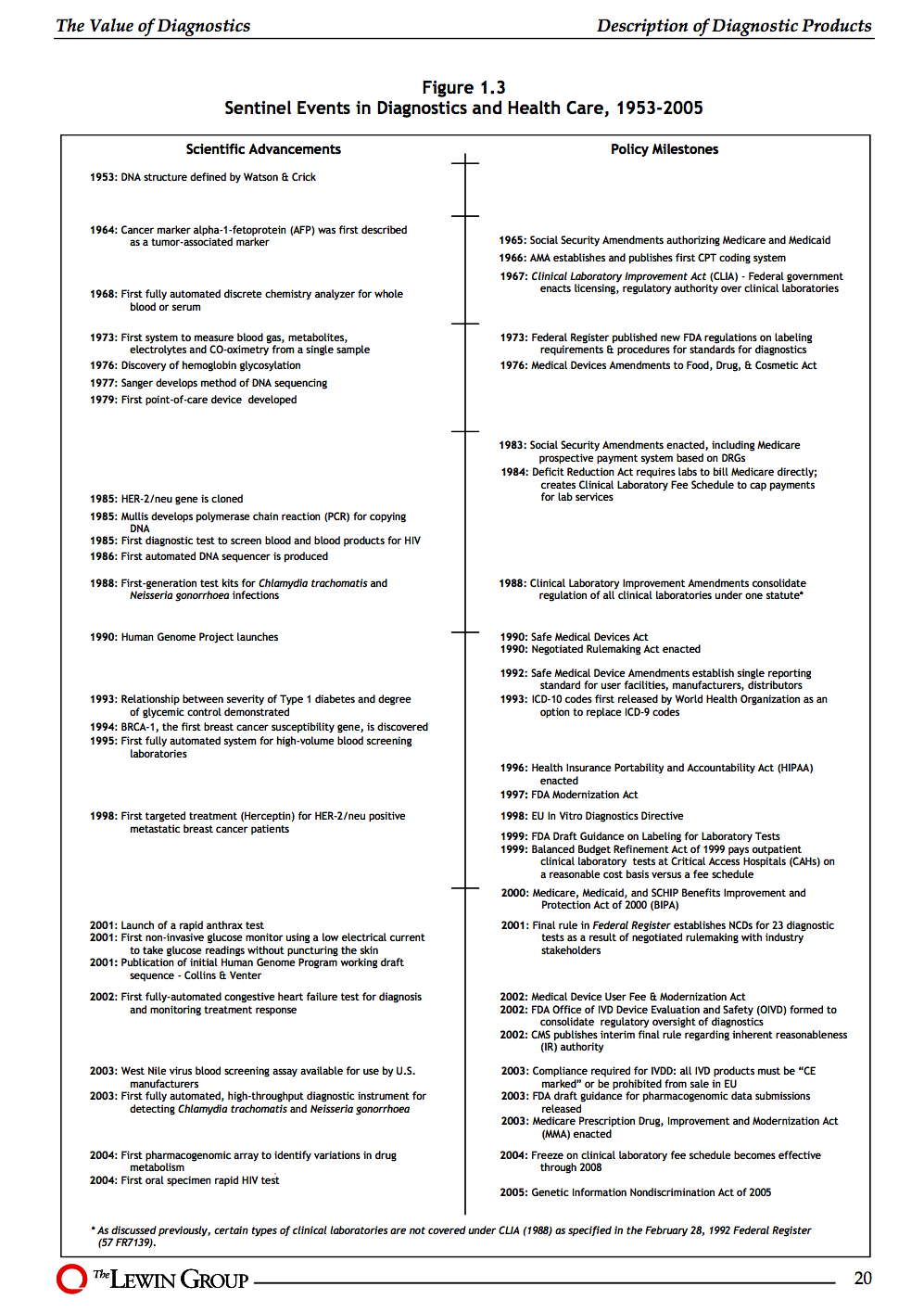

How was this field born and how is it evolving?

What are the main business models?

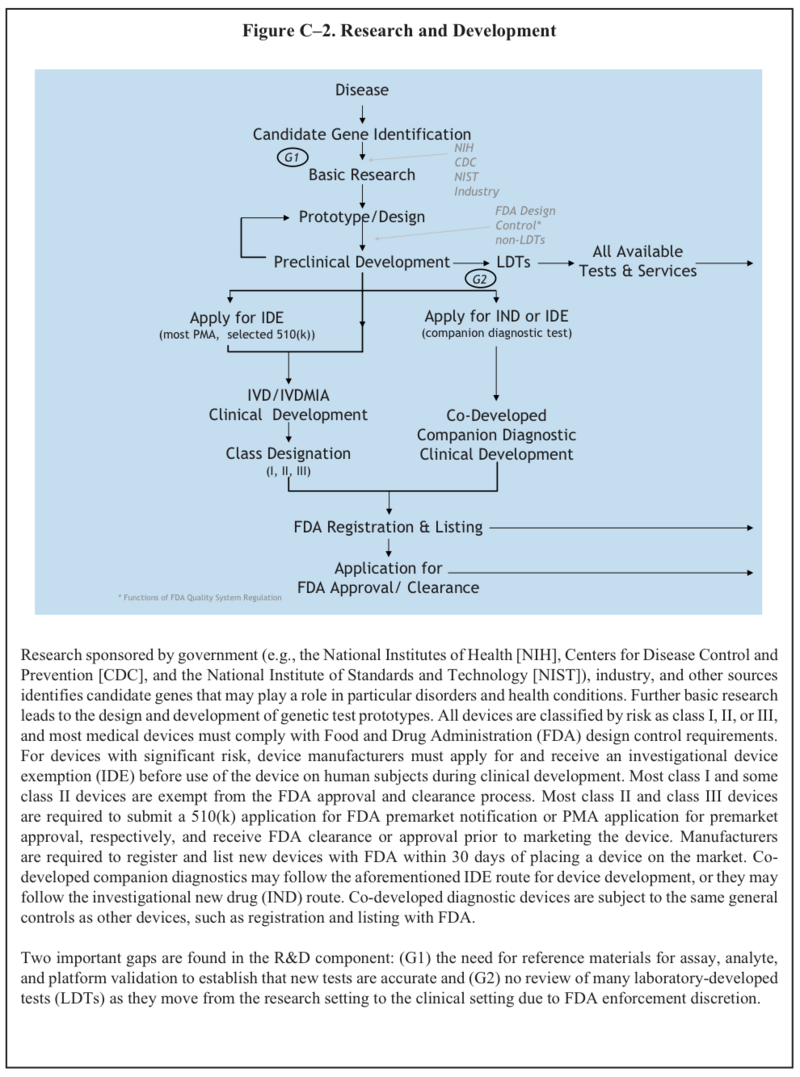

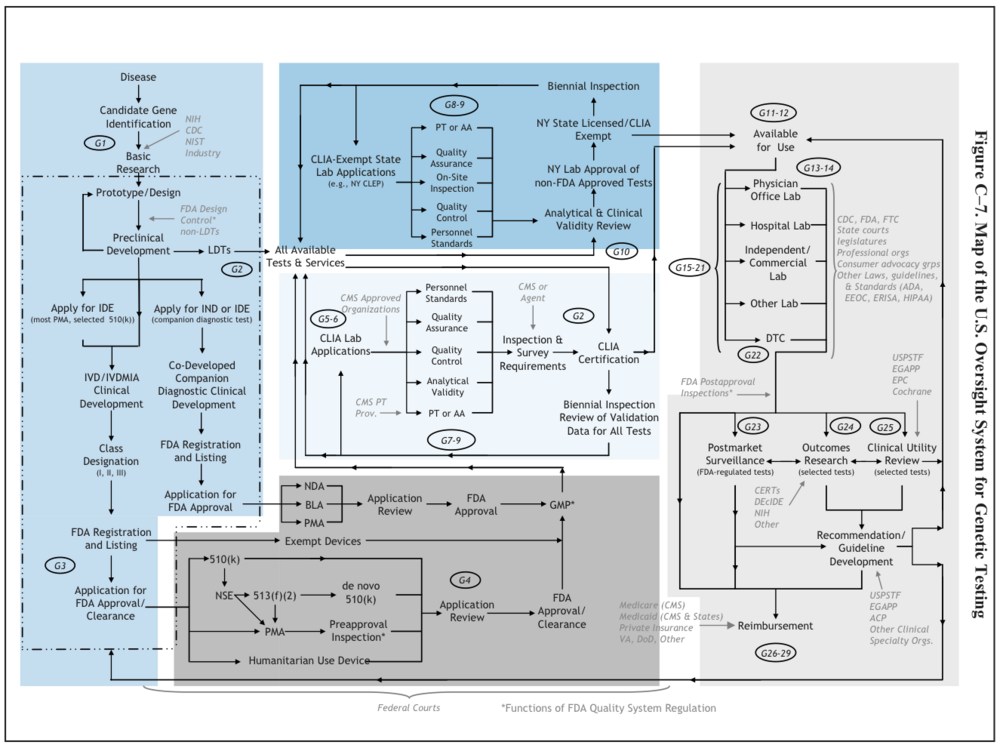

Regulation

U.S. System of Oversight of Genetic Testing: A Response to the Charge of the Secretary of Health and Human Services, Report of the Secretary’s Advisory Committee on Genetics, Health, and Society, April 2008. pg.242

What are the innovation dynamics in this field? (inputs/outputs, timing of innovation/ disruptive or incremental innovation?)

How does knowledge flow in this field?

(ADDED TO PAPER)

- Access to Bio-Knowledge: From Gene Patents to Biomedical Materials

- "Recent empirical studies, however, indicate that access to materials is a much more serious problem than patents are for basic biomedical researchers, and access to materials is also a critical problem for producers of biomedical end products like biopharmaceuticals." (quoting the abstract)

- Specific Legislative Efforts

- Genomic Research and Diagnostic Accessibility Act of 2002 (proposed)

- The Genomic Research and Accessibility Act of 2007 (proposed)

- Definition of Biological Knowledge

- Yochai Benkler’s framework for knowledge classification (page 26)

- information

- human knowledge,

- information-embedded tools

- information-embedded goods

- Patent information protects: usually "sequence and function of a given gene" which does not prevent an access problem to basic research (page 28)

- The access problem is in "information-embedded tools"

- See Zhen Lei, Rakhi Juneja & Brian D. Wright, Patents Versus Patenting: Implications of Intellectual Property Protection for Biological Research, 27 NATURE BIOTECHNOLOGY 36, 37 (2009) (a survey of ninety-three US agricultural biology faculty)

- barriers found:

- not patents

- material transfer agreements (MTAs)

- use has increased

- delay has increased: "Thirty-four faculty (42%) experienced a total of ninety-seven delays in research, with an average delay of 8.7 months" (page 28 of [1])

- barriers found:

- John P. Walsh, Wesley M. Cohen & Charlene Cho, Where Excludability Matters: Material Versus Intellectual Property in Academic Biomedical Research, 36 RES. POL’Y 1184, 1191 (2007)

- Of the academics surveyed, "about 75% had made at least one request for materials or data in the past two years, but 18% of requests to academics and 33% of requests to industry went unfulfilled (page 29 of [2]

- non-compliance with MTA requests is an important barrier

- This access problem is governed by social norms

- Adhering to this norm increases the transaction cost of sharing

- How can this cost be reduced? "This cost may be reduced both through initiatives to streamline the contracts covering transfers and through increased use of material depositories." (page 34 of [3])

- Possible Solution: Science Commons Biological Materials Transfer Project

- See Zhen Lei, Rakhi Juneja & Brian D. Wright, Patents Versus Patenting: Implications of Intellectual Property Protection for Biological Research, 27 NATURE BIOTECHNOLOGY 36, 37 (2009) (a survey of ninety-three US agricultural biology faculty)

- Yochai Benkler’s framework for knowledge classification (page 26)

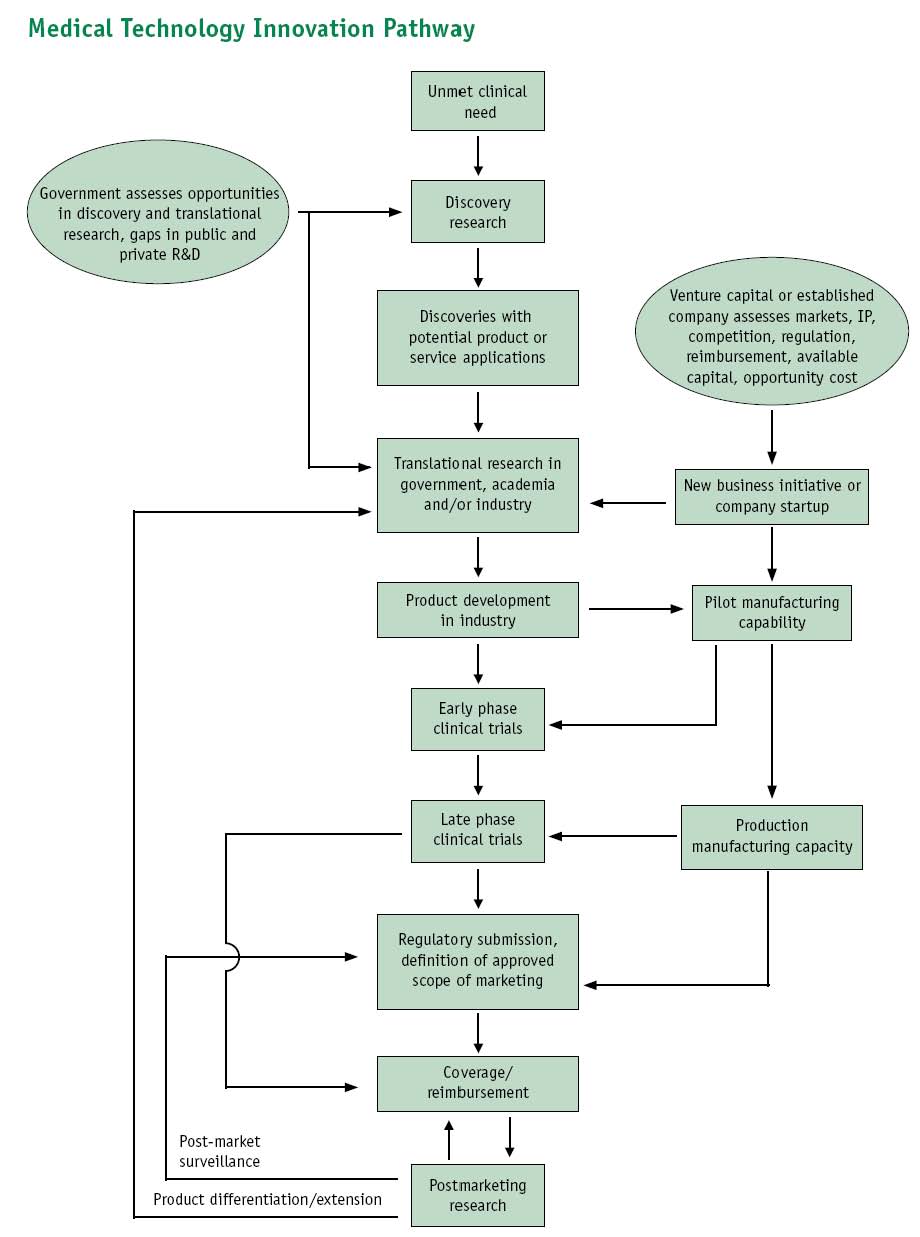

Notes on Research Commercialization Pipeline

(ADDED TO PAPER)

It looks something like this, where Dx represents the targets of genetic diagnostics:

Samples(MTAs?), Narratives -> Basic Research -> Dx genes & biomarkers, Narratives -> TTOs (patents) -> Commercialization (licenses) -> Trials / Peer Review -> Marketing

Questions / notes:

- How are human tissue samples controlled during the basic research stage?

- Are putative Dx genes and biomarkers always patented by the TTO before publication? Or are some described in literature before IP?

- The value of a research output a TTO protects is often unclear, hence the TTO is willing to negotiate for an exclusive license to make the protected technology as desirable from a commercialization perspective as possible

- Often small start-ups obtain exclusive licenses from the TTOs. Are they often then acquired by large corporations? Is it easier for large companies to purchase small ones w/ exclusive licenses rather than negotiating w/ TTOs to begin with?

Image of Pipeline diagram provided in: Priorities for Personalized Medicine, prepared by your Council of Advisors on Science and Technology (PCAST). Available at: http://www.ostp.gov/galleries/PCAST/pcast_report_v2.pdf

Is this field replicating models from other fields?

How many companies?

major companies in Personal Genomics industry

Sequencer Manufacturers

- Illumina

- Solexa

- 454

- CompleteGenomics.com

- PacificBio

- Helicos

Full Genome Sequencing providers

- Knome.com: full genomic sequencing and 2 years research updates; personal genetic counseling. Only $68,500.

- EveryGenome.com: $48,000 full genome sequencing by Illumina. Requires physician request.

- PersonalGenomes.org: Plans to offer free genomic sequencing to 100,000 volunteers. Currently working on the first 100. Jason Bobe works here.

Recreational and Clinical Genomic diagnostics

- Coriell Personal Medicine Collaborative - cpmc.coriell.org: Free Affymetrix GeneChip SNP sequencing, but only for "potentially medically actionable" conditions. Currently this list includes 10 conditions, and will grow as the Informed Cohort Oversight Board approves more conditions.

- 23andMe.com: Offers ancestry and health genomic analysis with an Illumina 550,000 SNP chip for between $399-$499. Results are not clinically useful.

- DeCODEme.com: $195 - $985 for up to 48 genetic conditions using a 100,000 SNP chip. In Bankruptcy proceedings.

- Counsyl.com: offers a (I presume) a chip-based screen for 100 genetic disease markers, including some for cystic fibrosis. Trying to sell both direct to consumers and clinically and aiming for insurance coverage. DTC costs $349. Not sure how they ensure the results are clinically useful.

- Navigenics.com: offers chip-based testing for 28 different conditions along with personal genetic counseling for $999. Not sure how they ensure the results are clinically useful. Want to be clinically used.

- PathwayGenomics.com: offers carrier testing for 61 genetic diseases, metabolism genes for 9 different drugs, as well as ancestry analysis for $199-$399. Not sure how they ensure the results are clinically useful.

- DNADirect.com - not sure what their product is.

- GenomicHealth.com / OncotypeDX.com : 21-gene expression assay that predicts recurrence of certain kinds of breast cancer. Considered a multivariate assay and regulated by the FDA; has more clinical data than most other genetic diagnostics demonstrating it's clinical validity and utility. Covered my insurance more often than other tests.

Diagnostic Kit Manufacturers

Diagnostic laboratories

Hospital Labs

Reference labs

"The major national reference labs including Quest, LabCorp, Specialty/Ameripath, Mayo and others account for at least 60% of the market for esoteric test services. The remaining 40% is shared by a group of some 3000 small, local market laboratories. The major reference labs have built a comprehensive menu of specialized test services and continue to expand their offerings via collaborations with leading medical research centers. They offer a huge presence in the market and manage distribution networks that touch just about every medical specialty. Thus many CLIA-registered company sponsored test services avail themselves of the marketing resources offered by the national reference labs."

Quest and Labcorp are the two dominant national reference labs. Financial information can be gotten from the SEC by using the Standard Industrial Classification 8071: Services - medical laboratories, which includes Quest, Lab-Corp, Bio-Reference, Athena, and ~120 others.

- Quest (wikipedia) DGX stock symbol. (SEC CIK#: 0001022079 )

- 2008 10-K - Annual Report

- Net Sales of gene-based & esoteric tests: 1,400 Million (20% of total revenue).

- 2008 10-K - Annual Report

- LabCorp wikipedia. LH stock symbol. (SEC CIK# 0000920148)

- 2008 10-K - Annual Report

- Net Sales of Genomic & Esoteric tests: $1,478.3 Million (+5.9% from 2007)

- Volume of Genomic & Esoteric tests: 23.7 Million

- Patents, licences, and technology "2008 gross carrying amount": 94.7 million

- 2008 10-K - Annual Report

- Bio-Reference Laboratories INC (SEC CIK# 0000792641)

- 2008 10-K - Annual Report

- Net revenue from esoteric tests (50%): $150.5 Million

- 2008 10-K - Annual Report

- Athena Diagnostics INC (SEC CIK# 0001161704)

How much money do they make or how much money do they “move” in the American economy?

How important is research from universities in this specific field?

Very important. The "inventor class" for genetic tests are located primarily at academic institutions and commercial research labs. (SACGHS Patent report has more info, look for "inventor class")

How important is public funding in this field?

Very important - the majority of research is publicly funded (SACGHS Patent report has more info). Universities are obligated to commercialize appropriate advances by the Bayh-Doyle act, which Tech Transfer Offices usually implement by seeking patent protection for discoveries with commercial potential.

How important is private funding / venture capital in this field?

Private funding seems to be critical to the strategy and growth of of start-ups spun-off from research institutions to commercialize promising diagnostic technology. Importantly, private funders evaluate if and how much to invest in these start-ups based on the intellectual property the start-up controls and the expected commercial price of the diagnostic product (which can experience downward pressure from insurance providers and competition).

Exclusive licensing is seen as necessary for start-ups that will have to ... pass clinical trials (Oncotype DX anecdote about $100 million first test). Typically this applies more to IVD manufacturers than LDTs, which have lower regulatory burden and traditionally develop comesurate with clinical demand for the test. IVDs instead have to demonstrate clinical and validity and utility both for the FDA and to gain endorsement by clinical associations